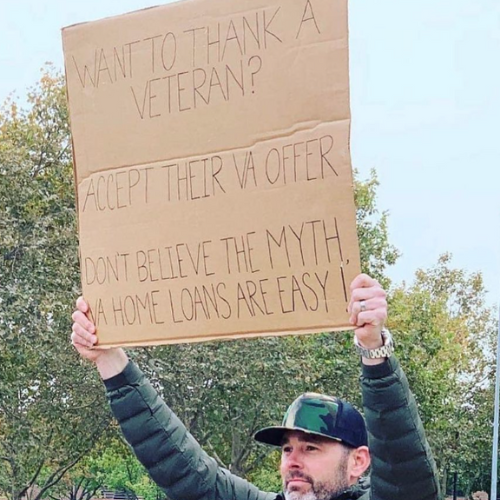

The Undeniable Benefits of Accepting VA Home Loan Offers for Home Sellers

Many home sellers and real estate agents are hesitant to accept VA loan offers due to widespread misconceptions about the process. However, this not only does a disservice to the Veterans and military families who have earned this benefit through their service, but also misses out on some of the best-qualified buyers in the market.

Below, we’ll explore the advantages of considering VA loan offers and debunk common myths surrounding these loans.

High Success Rate for Closing

On average, VA buyers are more likely to reach the closing day than other types of buyers. Preapproved VA buyers are among the strongest candidates in today’s lending climate, offering greater assurance that they have what it takes to close the deal.

Smooth Loan Processing Times

Contrary to popular belief, VA loans have made significant strides in technology over the past decade, ensuring they keep pace with other loan products. In fact, over the last two years, the average conventional purchase loan closed just three days faster than the average VA purchase loan.

Flexible Underwriting Criteria

VA loans have a more relaxed underwriting process compared to conventional loans, including looser credit score requirements and higher debt-to-income ratios. This means sellers are less likely to encounter issues with the borrower’s income or credit history, providing added peace of mind.

Myths About VA Appraisals

VA appraisals involve both valuation and an assessment of property conditions, known as Minimum Property Requirements (MPRs). Homes don’t need to be in perfect condition to pass the appraisal, and any flagged issues may be addressed with VA exemptions or by the buyer undertaking the necessary repairs.

No Obligation for Closing Costs

Sellers are not required to cover any of the VA buyer’s closing costs, including fees that Veterans are not legally allowed to pay. Negotiations regarding closing costs remain between the buyer and seller.

Flexible Closing Arrangements

Veteran homebuyers deployed during their home buying journey can use a power of attorney (POA) to handle the closing, ensuring a seamless process.

Broaden Your Buyer Pool

By considering VA loan offers, home sellers can widen their potential buyer pool and increase their chances of receiving strong offers. VA borrowers have served our country, and giving them a fair opportunity to purchase a home is the least we can do.

In conclusion, VA buyers are excellent candidates for making strong offers and reaching the closing day without any obstacles. Don’t let misconceptions about VA loans prevent you from offering Veterans, active service members, and military families a fair shot at the dream of homeownership.