Refinancing at a Higher Rate and Consolidating Debt: A Smart Strategy to Reduce Monthly Payments

As counterintuitive as it may seem, refinancing at a higher rate and consolidating debt can be a great option for borrowers looking to lower their monthly payments. While a higher interest rate may not sound like the most desirable outcome, the overall benefits of refinancing and consolidating debt can help individuals better manage their finances and improve their financial health. In this article, we will explore the reasons why refinancing at a higher rate and consolidating debt can be a smart strategy for many borrowers.

- Longer Repayment Periods

One of the primary reasons borrowers might consider refinancing at a higher rate is the ability to extend the repayment period of their loan. By stretching out the loan term, borrowers can effectively reduce their monthly payments, making it easier to manage their financial obligations. This can be particularly beneficial for individuals who are struggling with high-interest debt or are experiencing financial hardships.

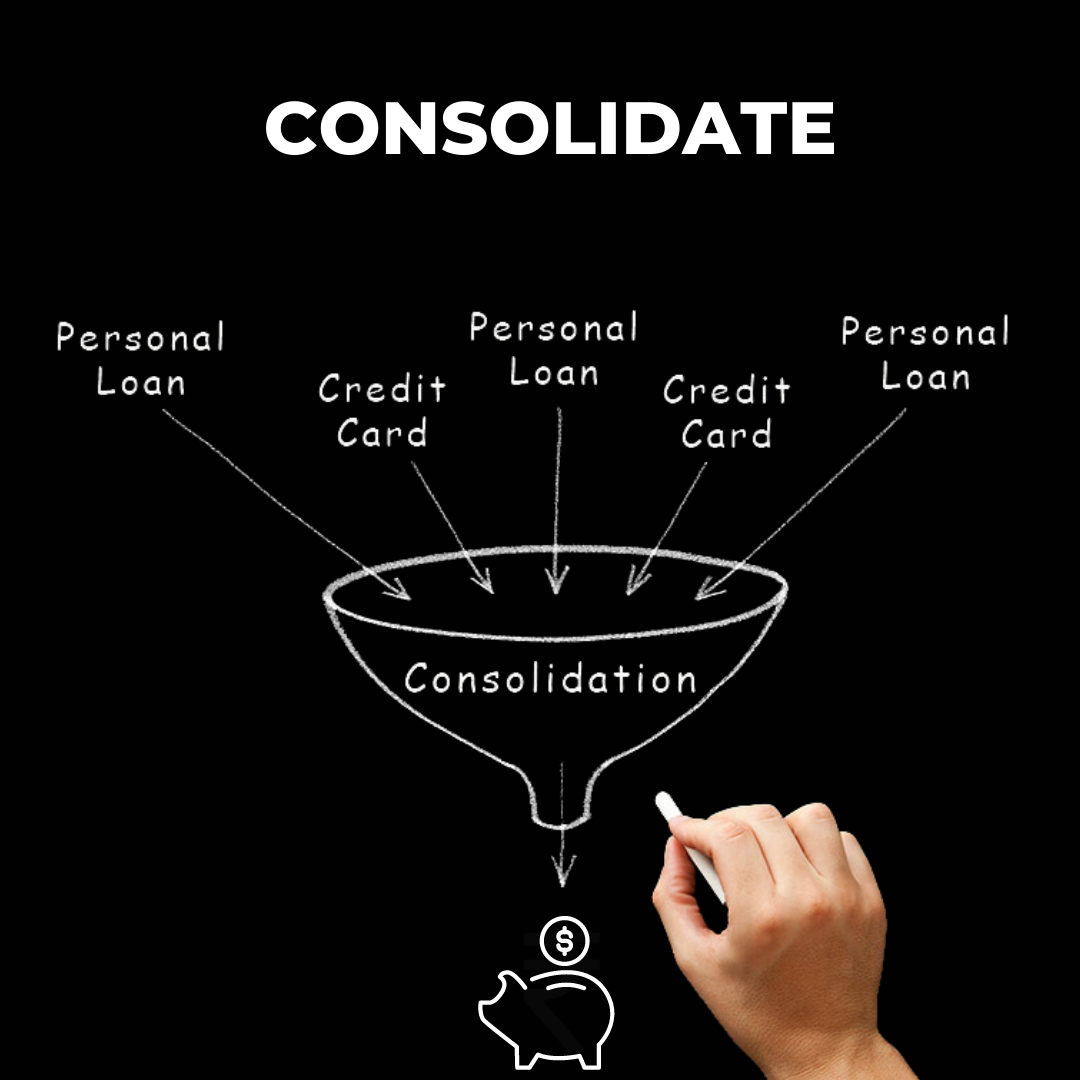

- Debt Consolidation

Debt consolidation is the process of combining multiple loans or credit card balances into a single loan with a new interest rate and repayment terms. Refinancing at a higher rate can help borrowers consolidate their high-interest debt into a single, more manageable monthly payment. In many cases, the new interest rate may be higher than the original loan’s rate but lower than the rates on other high-interest debts. This can result in significant savings over the long term and make it easier for individuals to pay down their debt.

- Simplified Debt Management

Refinancing at a higher rate and consolidating debt can make managing personal finances more straightforward. By reducing the number of separate monthly payments, borrowers can simplify their budgeting and have a clearer picture of their overall financial situation. This can help individuals stay organized and make more informed decisions about their financial future.

- Improved Credit Score

Consolidating debt can have a positive impact on a borrower’s credit score. When multiple loans or credit card balances are combined into one loan, the borrower’s credit utilization ratio – the amount of credit used compared to the total credit available – can decrease. This can lead to an improved credit score, which can result in better terms for future loans or lines of credit.

- Potential Tax Benefits

Depending on the type of loan being refinanced, borrowers may be eligible for certain tax benefits. For instance, the interest paid on a mortgage or home equity loan may be tax-deductible, providing additional savings that can offset the higher interest rate.

Although refinancing at a higher rate might seem counterproductive, the benefits of consolidating debt and reducing monthly payments can make it a viable option for many borrowers. By extending repayment periods, simplifying debt management, and potentially improving credit scores, refinancing at a higher rate can lead to greater financial stability and peace of mind. As with any financial decision, it’s important to weigh the pros and cons and consult with a financial advisor to determine if this strategy is right for your unique financial situation.