AI is Shaking Up the Mortgage and Appraisal World

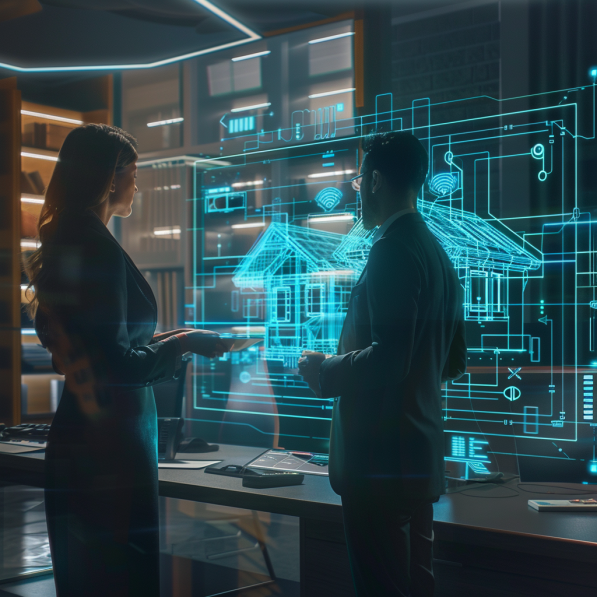

Artificial intelligence (AI) has been making waves across various industries, and the mortgage and appraisal sectors are no exception. As we witness this technological transformation, it’s becoming increasingly evident that AI is not just a passing trend, but a powerful tool that is reshaping the way we work, leading to improved efficiency, accuracy, and reliability.

AI’s impact is most notable in its ability to streamline tasks that were previously time-consuming and susceptible to human error. Through advanced machine learning algorithms and data analytics, AI is revolutionizing the way we gather, analyze, and identify risks in the mortgage process. From automating repetitive tasks to enhancing appraisal accuracy and optimizing resource allocation, the potential for AI to improve operations is significant.

However, it’s crucial to address the misconceptions that often surround AI. Some may fear that AI will completely replace human appraisers, making their expertise redundant. Others might believe that AI is only accessible to large institutions with extensive resources. In truth, AI is designed to augment human expertise, not replace it. It is a tool that empowers professionals to make more informed decisions, while still leveraging their knowledge and experience.

Innovative companies like Jaro are at the vanguard of this AI transformation, seamlessly integrating AI and workflow automation to streamline appraisal quality control, reduce manual interventions, and enhance overall productivity. By harnessing the power of AI, these companies are establishing new benchmarks in the industry, showcasing that embracing technology is essential to remaining competitive in an ever-evolving landscape.

Nevertheless, as with any transformative technology, there are legitimate concerns that must be addressed. The potential for AI to introduce biases, lack transparency, and potentially impact jobs cannot be overlooked. To mitigate these risks, proper training, calibration, and human oversight are essential. It is only by finding the right balance between AI and human expertise that we can truly maximize the benefits of this technology while minimizing its drawbacks.

As we look ahead, it’s clear that AI represents a significant shift in the mortgage industry. It promises to redefine traditional processes, enhance overall efficiency, and unlock new opportunities for growth and innovation. The key to success lies in embracing AI as a powerful tool, working in tandem with human expertise to create a more streamlined, accurate, and reliable mortgage and appraisal process.

The integration of AI in the mortgage and appraisal industries is not a question of if, but when. As we navigate this exciting new landscape, it is crucial to approach AI with an open mind, a willingness to adapt, and a commitment to leveraging its potential to drive positive change. By doing so, we can shape a future where AI and human expertise work together harmoniously, ushering in a new era of efficiency, accuracy, and growth in the mortgage and appraisal sectors.

The AI revolution is here, and it’s an exciting time for appraisers and mortgage professionals alike. By embracing this technology and working together, we can create a brighter, more efficient future for our industries.